Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

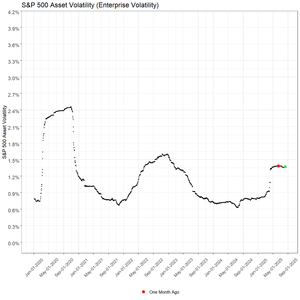

option volatility has some properties of foresight in that it is sticky, stays ion regimes. this means any large change in price underlying will be matched with a change in volatility or respected and will move to a new regime.

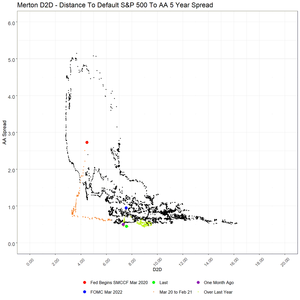

corp credit spread is an option price

so if there is a new regime or move in price, must have a move in credit spread or regime change in volatility - this is called "persistence"

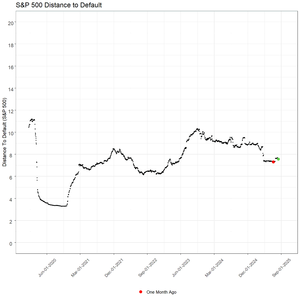

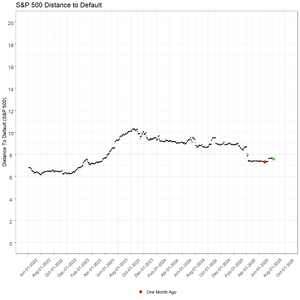

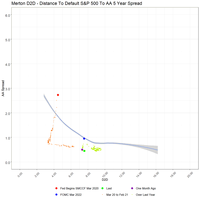

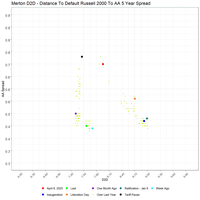

currently AA credit spreads when qualified by "d2" (in Black Scholes Merton and called 'distance to default' or D2 by Merton) are in an untenable level to AA credit spread as the underlying - I use SPX - has rallied yet volatility has not moved, has straight lined.

this is based on 6 month realized volatility (would love to have implied 6 months 10% out of the money call implied vol on SPX - by the way) while SPX has reached all time highs. it is transformed to "d2" which should rally to confirm the rally (or vice versa)

this has not occurred which I cannot recall happening before in a underlying rally.

this means that either asset vol based on equity vol drops significantly raising d2 or the underlying - SP500 rallies another 20% raising d2 - or AA credit spreads blows out by 100 basis points or so- ir the underlying drops 20%.

the point being that in terms of "norm" of capital structure pricing, the current levels in volatility, equity level, and credit - all three or just one or two - is in a historically unstable status now. I suspect equity levels crash.

@threadreaderapp unroll

4,18K

Johtavat

Rankkaus

Suosikit