Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

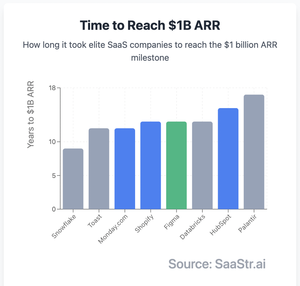

Does it matter, within reason, how fast you get to $1B ARR? Maybe not. For the best at least, there appears to be almost no correlation between market cap after $1B ARR ... and relative speed to $1B ARR.

Palantir was the slowest of this elite group of 8 to hit $1B ARR.

Today, it's worth the most, at $375 Billion.

-Snowflake (fastest, 9 years): $65B value

-Shopify (12 years): $108B value

-Palantir (slowest, 17 years): $35B value

Getting to $1B ARR matters. How fast though? That's murkier.

▶️Shopify (12 years) is worth more than Snowflake (9 years)

▶️Palantir (17 years) is worth more than HubSpot (15 years)

Market timing, TAM size, and business model matter more than speed to $1B ARR.

Figma's patient approach (13 years) with profitability may prove more valuable long-term than pure speed.

Figma certainly in the end didn't lose anything being more patient.

10,16K

Johtavat

Rankkaus

Suosikit