Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

New SEC Chair Atkins and @HesterPeirce announce PROJECT CRYPTO, and crypto-lawyers around the country rejoice.

Crypto is legal again in America, and financial regulators like the SEC are finally committing to working with innovation, rather than against it.

Some thoughts 🧵

1/ The SEC's goal is to "enable America's financial markets to move on-chain." (I'll forgive them for misspelling "onchain")

They see blockchains as a financial modernization on par with the DTCC in the 60s and electronic trading systems in the 1990s—a generational revolution.

2/ To help us move capital markets onchain, they first need to bring crypto markets back onshore. They pledge to do this in two parts:

1st, by removing barriers that drive token launches to places like BVI or Panama;

2nd, by removing the "scarlet letter" of security status.

3/ I'm particularly excited by that second point. Security status should not kill a project. Clarification alone doesn't fix that. The SEC now agrees that crypto projects should be able to offer security-like features without compromising the benefits of being onchain.

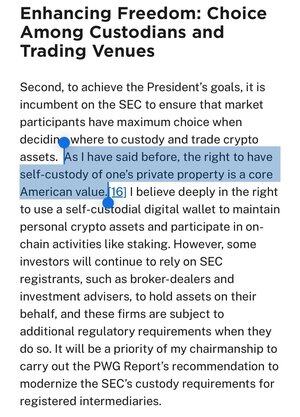

4/ Crypto has always been about more than finance. I would have left the space long ago if this was all just fintech with extra steps. It's about the fundamental right to property, which the SEC calls out explicitly.

There's so much more to say here. This is huge.

5/ Crypto is digital property rights. Crypto without self-custody is like property without possession. In a big turnabout from the Gensler era, the SEC now understands that self-custody is not incompatible with investor protection because self-custody __is__ investor protection.

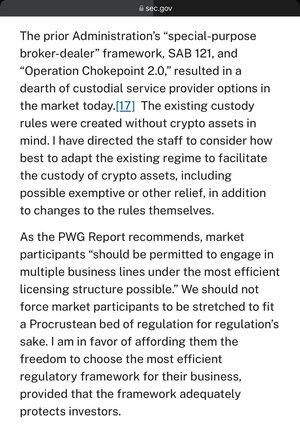

6/ In addition to regulatory compatibility with self-custody principles, the SEC will modernize custody frameworks so we can get a little more protection in "not your keys, not your coins" scenarios.

This means an end to SAB 121 and Chokepoint-style regulatory hostility.

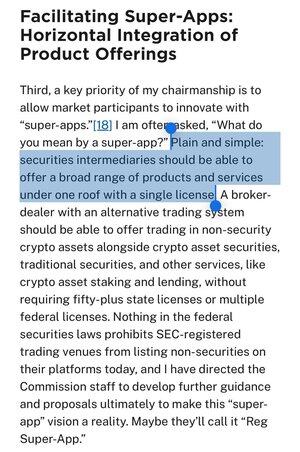

7/ Legalizing "super-apps" where users can buy securities, transact with stables, stake their tokens, and more would open the door to innovative uses of crypto within non-crypto-native apps.

So many abandoned use cases from outside the trenches can now be revisited.

8/ "Decentralization" has meant a lot of different things over the years, most of which weren't coherent. Decentralization theater has been a disaster and has tarnished crypto's brand. Hopefully that ends now that the SEC understands that decentralization=disintermediation.

9/ For years, lawmakers and regulators have been forcing intermediation (sometimes explicitly, usually implicitly) into crypto. Like banning self-custody, forced intermediation makes crypto pointless.

Look for rule changes that accommodate disintermediated transactions.

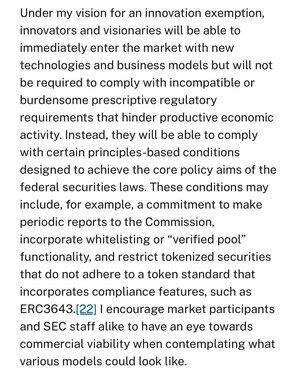

10/ Last but not least, a possible "innovation exemption" would be incredibly bullish for @alliancedao founders in particular. Details are vague, but we've seen sandbox proposals where builders can prove a product first before spending their scarce capital on registrations.

There is still so much work to be done, but between this and the White House's Crypto Working Group's Report released yesterday, all the right notes are being played. Crypto is not merely FinTech, it's not going to stay hidden in the trenches, and it's not going to have it's core values of property rights and disintermediation stripped out of it by overly cautious regulators.

Bullish.

@alliancedao I should probably also link to the actual speech, it's a good read!

1.8. klo 03.16

Here's the SEC's plan for Project Crypto:

2,13K

Johtavat

Rankkaus

Suosikit