Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The best ways to get exposure to $kHYPE.

🧵

II. TL;DR:

1. Provide liquidity or buy YT on @pendle_fi (until November 13).

2. Use @HypurrFi to loop: deposit $kHYPE and borrow $wstHYPE (keep a health rating of 1.06 for safety).

3. Stake $kHYPE directly on @kinetiq_xyz.

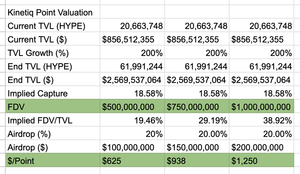

III. Running through numbers, @PendleIntern estimates between 70-230% ROI based on $500M/750M/1B FDVs.

He assumes:

- Airdrop scheduled for early December

- 200% TVL growth

- 20% of the allocation reserved for the airdrop

IV. I believe it's the best choice you'll ever make because you gain exposure to 678 kHYPE for just $1,000.

Additionally, you will yield 13.43%.

V. "What about the looping strategy?"

High LTV.

$wstHYPE borrowing costs remain low because utilization is low, making it cheap to borrow and loop.

VI. "And what about just staking $kHYPE?"

It's the simplest strategy. You just earn a 6% yield on $kHYPE. Maybe, @kinetiq_xyz will add points from @felixprotocol and/or @hyperlendx and you will earn them too. But not yet.

VII. Also, we know that @kinetiq's points started on 15 July, with 8,000 points distributed per week.

Assuming a late TGE on 2 December, we'd be looking at a total of 160K Kinetiq points.

Note: That's why I think fixed weekly point distributions = @pendle_fi YT's superior, as early exposure is the best choice.

What do you, bois, think of @kinetiq_xyz?

@splinter0n @0xDefiLeo @the_smart_ape @0xCheeezzyyyy @DOLAK1NG @YashasEdu @0xAndrewMoh @eli5_defi @_SmokinTed @RubiksWeb3hub @kenodnb @lstmaximalist

I hope you've found this thread helpful.

Follow me @belizardd for more.

Like/Repost the quote below if you can:

13,52K

Johtavat

Rankkaus

Suosikit