Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Token unlocks strategies are still printing?

Many people still don't know or ignore its existence.

Here's why it's important {Explain like I'm five version} / 🧵

>| α / {What’s the deal with Token Unlocks?}

> Token unlocks are when coins that were locked up {like for the team, investors, or community rewards} finally hit the market.

> When tokens unlock, supply increases, potentially lowering prices if holders sell.

> Sites like @Tokenomist_ai show when coins launch, who gets them, and what part of the supply is released, dates and more

>| β / "How it exactly works? 1/2"

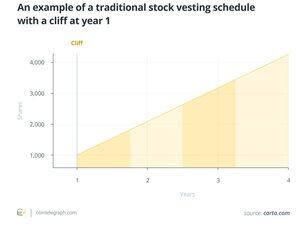

> Token unlocks occur through vesting schedules using smart contracts or multisigs.

> When unlock dates hit -> tokens become transferable -> letting recipients sell, stake, or move them, which can spike supply and pressure prices.

> On-chain, you’ll see vesting contracts releasing tokens, big wallet moves, and exchange inflows...

>| γ / ...2/2

> After token unlocks, restricted tokens are released, leading to price swings or dumps.

> Vesting aligns early investors with long-term goals, but big holders may sell gradually or use OTC deals and derivatives.

> This means that, unlock events offer both risks and opportunities at the same time, and smart people play on this.

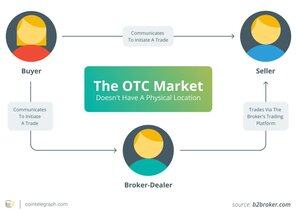

>| δ / "What about strategies?"

> VCs often use over-the-counter {OTC} deals to sell large amounts of tokens without crashing the market.

> Instead of dumping on exchanges, they work with OTC desks to privately match with big buyers at a negotiated price, usually just under market.

> This approach helps them avoid slippage, maintain anonymity, and structure deals with greater flexibility.

>| ε / VCs sell unlocked tokens in smaller parts during market pumps and may buy dips to reduce costs.

> They hedge using derivatives like shorting futures, buying puts, or selling calls to secure profits and limit risks.

> Some aim for delta-neutrality, partnering with market makers to profit regardless of price movements.

>| ϝ / Tho... Retail traders like you and me can’t hedge like VCs, but we can track vesting schedules, spot upcoming unlocks, and plan around potential sell pressure.

> Avoid jumping in before major unlocks, and monitor on-chain activity, price, and volume for hints.

> Consider trimming positions or setting stops, not all unlocks are bad, solid projects might absorb them well.

> Tagging real chads of CT? Not following them? Think about it again:

> @belizardd @DeRonin_ @kem1ks @splinter0n @terra_gatsuki @0xAndrewMoh @KingWilliamDefi @0xJok9r @0xDepressionn @cryppinfluence @CryptoShiro_ @the_smart_ape @AlphaFrog13 @0xTindorr @Hercules_Defi @eli5_defi @CryptoGideon_ @0x99Gohan @rektdiomedes

Thanks for reading my thread!

If you enjoyed this thread:

➮ Follow me @0xDefiLeo.

➮ RT the tweet below to share this thread with your audience.

3.8. klo 05.56

Token unlocks strategies are still printing?

Many people still don't know or ignore its existence.

Here's why it's important {Explain like I'm five version} / 🧵

3,9K

Johtavat

Rankkaus

Suosikit