Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Figma’s IPO popped >150%, which means they technically left $650M on the table

• IPO priced at $33, opened at ~$85, now at ~$105.

• 37M shares sold of which 12.5M were primary

• If IPO was priced at $85, Figma would have $650M more cash (and still a healthy 20-25% pop).

• But with a market cap now more than 2.5x expectations, doubt they care too much about the “lost” cash

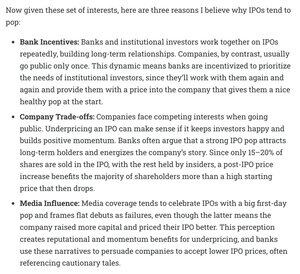

here's what I wrote 5 yrs ago about why IPOs tend to pop

22,43K

Johtavat

Rankkaus

Suosikit