Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

July FOMC Recap🧵

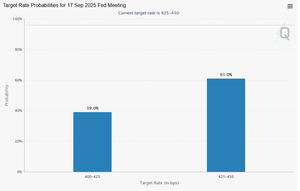

Powell holds rates steady at 4.25–4.50% for 5th straight time, signals patience > panic.

🔹 DXY spikes

🔹 Stocks flat

🔹 Bitcoin dips

🔹 September cut odds? Now just 50%

Full breakdown of the Fed's cautious tone, dissents & market reaction 👇

30.7.2025

📈 Arbitrum Ecosystem Is Heating Up this JULY:

• Transactions: 2.93M (+73%)

• Throughput: 5.67 Mgas/s (+97%)

• Stablecoin Supply: $8.17B (+22%)

• TVL: $18.07B (+29%)

💥 Top Gainers in TVL % Growth:

▫️ @Factor_fi – $21.39M (+35,331%)

▫️ @SushiSwap – $19.91M (+119%)

▫️ @eulerfinance – $17.33M (+115%)

▫️ @USDai_Official – $48.75M (+95.09%)

▫️ @torosfinance – $21.33M (+77.82%)

The momentum is real ⚡️

1/ The Decision:

▪️ FOMC voted 9–2 to pause

▪️ Dissenters (Bowman, Waller) wanted a cut

▪️ Fed says growth moderated, inflation still elevated, and uncertainty is back on the table

No clear pivot, just more waiting.

2/ Powell’s Message

▪️ “We’ve made no decision about September”

▪️ Inflation above 2%, labor market stable

▪️ Rates are “modestly restrictive” — Fed is in data mode, not cut mode

Markets took this as a hawkish hold.

3/ Market Reaction

▪️ Stocks: Flat to down

▪️ Yields: Spiked on fading cut hopes

▪️ DXY: Jumped ~1% to 2-month high

▪️ Crypto: BTC dipped from $118.8K to $117.3K

→ No panic, just reset expectations.

4/ Key Risks

▪️ Tariffs may fuel inflation

▪️ Powell: Could be short-term or sticky

▪️ Reaffirmed inflation fight > politics

→ Shrugged off Trump’s pressure to cut

5/ September Cut?

▪️ Odds dropped from 75% ➝ ~39%

▪️ Powell warned against acting “too soon”

▪️ Repeated: “No preset course”

Markets now eye Dec or later for first move.

12,74K

Johtavat

Rankkaus

Suosikit