Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Tanaka

The SEI ecosystem has been nonstop growing since the start of 2025, shown by its on-chain performance.

Daily Active Addresses: @SeiNetwork has seen a 4x increase in daily active addresses, jumping from 200K in Feb 2025 to 800K+ per day atm.

Daily transactions on #SEI are also booming, now averangting 5.5M txns per day, up from 3.5M–4M back in Feb.

The growth of TVL on SEI is impressive! TVL on SEI has seen the fastest growth in the last 7 days, with a 13.94% increase. Last week was one of the big weeks for SEI, and the momentum keeps going.

However, there’s still large fluctuations in SEI DEX trading volume, ranging from 25M to 100 million per day.

The cash flow might still be out of the chain, but I believe if SEI can maintain its current momentum, it’s only a matter of time before SEI eco really takes off.

7,66K

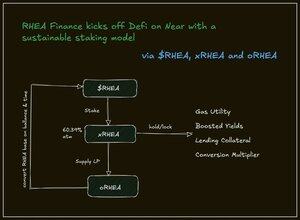

I think DeFi on @NEARProtocol is often overlooked.

I shared @rhea_finance previously cuz I believe Rhea will kick off the #DeFi wave in the Near ecosystem.

🔸Rhea Finance = Ref Finance + Burrow Finance

🔸Rhea is the first Near project listed on Binance Alpha

🔸It offers a chain-abstracted liquidity solution on Near with $249M TVL

But what really got me interested is how the fundamentals are already backing the hype.

🔸In just the past month, Rhea generated:

🔸$158K in real protocol revenue (30d)

🔸Averaging ~$6.6K per day

🔸With an annualized revenue of $1.94M already and over $820K cumulative revenue to date

That’s not small talk, especially for a DeFi app on NEAR.

What makes Rhea different is how the team designed tokenomics for long-term sustainability, not just short-term pump.

They’ve structured it into 3 layers: $RHEA → xRHEA → oRHEA

Here’s how it flows:

🔸Stake $RHEA → receive xRHEA

→ Current APY: ~60.39%

🔸Supply xRHEA → earn oRHEA

🔸oRHEA can be converted back to $RHEA

🔸Lock xRHEA → boost APY on lending positions

🔗 Stake here:

Personally, I think this is one of the strongest signs that NEAR’s DeFi is evolving.

Rhea is not just shipping features, it’s generating real yield, structuring incentives with care, and proving there’s room for sustainable DeFi outside the usual suspects.

And we might just be early.

10,12K

GM,

The recent dip is a healthy part of the market cycle.

Let's pick some $ETH $LTC $SOL.

If you’ve been holding for the long term, this is just a blip on the radar. Healthy corrections like this make sure the trend remains sustainable.

This correction is a good opportunity to accumulate before the next big move.

16,8K

If you're holding USDC, it's worth exploring how to put it to work on @SeiNetwork.

Here are some protocols where you can deposit $USDC and earn solid returns:

1/ @YeiFinance

🔸Leading lending protocol.

🔸TVL: 718.4M

🔸Supply USDC APR: 10,18% (Net: 4.72% in $USDC + 5.45% in $WSEI)

2/ @TakaraLend

🔸Lending protocol

🔸TVL: 124M

🔸Supply USDC APR: 13.54% (Net: 1.66% in $USDC + 11.88% in $WSEI

If #Sei continues on this track, it could evolve into a stablecoin-native yield layer, not just a fast L1.

9,72K

I believe #RWA is the fastest way for #Defi to scale in global level.

Despite growing attention from blue-chip companies, institutions, and TradFi giants, the potential of RWA is still vastly underrated.

If you're looking for a project that captures both compliance and innovation 👇🏻

I’m currently watching @RtreeFinance, the first compliance-driven RWA platform founded and based in Hong Kong.

Rtree is backed by GoFintech, MaiCapital (SFC-licensed), CSOP, HashKey, Sotheby’s, and more, combining real-world reputation with Web3 execution.

✨ So what does Rtree actually offer?

Lending Pool: Borrow against tokenized RWAs: art, property, rare collectibles with regulated custody, smart LTV, and tradable debt positions.

Marketplace: A 24/7, peer-to-peer venue to trade real-world assets *on-chain*.

Investment Square: Access to tokenized yield-bearing assets like REITs, bonds, and stocks with T+2 bridging, depository receipt models, and predictable yield backed by licensed institutions.

✨ What makes Rtree stand out?

Rtree solves the 3 big problems in RWA:

– Access → anyone can participate

– Liquidity → tokenized assets + active secondary markets

– Security → regulatory-grade custody and compliance at the core

✨ Rtree’s lending pool

Their first product Lending Pool just went live, offering 11–15% APY fixed-income loan.

– All loans are fully collateralized with conservative LTVs (30–50%)

– Mandatory KYC + legal contracts for all borrowers

– Assets professionally valued by 3rd parties

– $100K+ Insurance Fund grows from 10% of platform revenue

– Secondary token market for optional early exits

How it works:

1/ Rtree transforms traditional 1:1 loans into N-to-1 lending pools, spreading risk and increasing scale

2/ Collateral is tokenized into NFTs, then used to mint yield-bearing instruments

3/ Combines blockchain transparency with TradFi-grade risk controls

I think the real alpha is in infra that brings institutions and retail together. So, if you're serious about #RWA, Rtree is one to watch closely!

11,29K

gSEI,

@SeiNetwork onchain shows strength for months now, and this feels like one of those onchain setups that traders won’t appreciate yet.

While price has gone quiet, the chain hasn't.

Let’s unpack what I’m seeing 👇

🔸4.28M+ avg daily transactions

🔸800K+ daily active addresses

🔸87K+ new wallets/day

🔸TVL nearing $600M ATH

🔸$0.00004 median tx fee

🔸99.8% uptime

This is sustained usage under real conditions.

#SEI

10,21K

GM,

I’ve been tracking the ETF narrative closely, and it’s one of the main reasons I added $LTC and $SOL to my long-term portfolio.

These assets are still massively underpriced relative to their ETF odds.

Bloomberg’s analyst gave 90% approval odds for both @litecoin and @solana ETFs.

Yes, 90%.

Everyone waits for certainty, but I’m positioning before it’s obvious.

Sometimes the best trades come from quiet conviction, not noisy consensus.

Tanaka4.8. klo 15.42

I’ve been sharing @litecoin alot few weeks ago, along side with my biggest conviction $ETH.

While everyone’s chasing trends, $LTC quietly stacking every reason for a breakout and barely anyone’s talking about it.

Here’s why I believe $LTC is preparing for its most explosive move yet in 2025.

1/ The MEIP Effect

Most coins dream of attention from big money, Litecoin has it.

MEI Pharma invested $100M exclusively into $LTC, and that number recently doubled to $200M.

This is a treasury strategy, a long-term hold.

If the allocation grows to $400M, $600M, or more, that’s 4-5% of total supply potentially removed from circulation permanently.

2/ 4.2M $LTC Could Be Gone From Markets Forever

Based on wallet behavior, an estimated 4.2M LTC (~5% of the total supply) may be locked up for good.

Whether for treasury, cold storage, or strategic reserve, this silent drain creates one of the most favorable supply dynamics in crypto today.

And with a fixed supply of just 84M and emission already halved, every LTC off the market matters.

3/ Valuation Gap is Wild

At $112 and an $8.7B mcap, Litecoin looks like a forgotten relic to many.

But let’s zoom out:

– Same decentralized architecture as $BTC

– Faster, cheaper, and more scalable

– Clear legal classification as a commodity, no SEC drama

– Used more for payments than any other coin on BitPay

– Integrated into PayPal, Visa, Coinbase, Robinhood, Fidelity

It’s the most used crypto for payments globally and it trades at 1.5% of Bitcoin’s price.

4/ @litecoin is the Infrastructure You Forgot Was There

People forget:

– First coin to activate #SegWit

– First Lightning Network tx happened on Litecoin

– MWEB privacy upgrade already live

– 13 years uptime, no hacks, no scandals, no drama.

5/ The Asymmetry is Real

Here’s a thought experiment:

– If $BTC = $500K, and Litecoin reverts to just 5% of BTC’s value, $LTC = $25K

– If $BTC = $1M, and Litecoin climbs to 10%, $LTC = $100K

Even conservatively, $LTC at $1K is a fundamentally sound bet ,not just hopium.

6/ Not a Narrative Play

Litecoin isn’t trying to be the next Solana, not chasing AI, gaming, or memecoins.

It’s simply sound money.

No pre-mine, no central issuer, no VC tax, no ambiguity. Just pure, peer-to-peer digital cash the way Satoshi intended.

And in a world increasingly divided between regulated assets and speculative chaos, that clarity is going to matter.

Sometimes, you just need to pay attention to what’s quietly winning.

Litecoin might be the most inevitable.

22,43K

My first @OpenledgerHQ memory?

It wasn’t the tech.

It was the feeling that someone finally cared about where the AI answers came from.

I stumbled upon the #ModelFactory while researching domain-specific #LLMs and it just worked. No sluggish UI, no hallucinated responses.

I uploaded a small dataset and the results were crisp but more importantly, they were explainable.

That’s when it clicked for me.

This wasn’t just another AI tool. It was a foundation for trust.

I didn’t plan to stay long but now I’m deep in the stack.

And I’m not leaving anytime soon.

#OctoSnapboard #OPEN

Openledger4.8. klo 03.30

Let’s go back, how did your OpenLedger journey start?

Drop your first memory 🐙

665

Tanaka kirjasi uudelleen

EigenLayer × OpenAI = ChainOpera But this time, you can actually own it.

@ChainOpera_AI is the AI-native project already generating real revenue,

partnered with Samsung & Qualcomm, and preparing a $3B+ dual listing (token + equity) with Binance & OKX in the pipeline.

Why ChainOpera_AI is the next big thing? A thread 🧵

18,6K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin