Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

TokenLogic

We provide Capital Management Solutions for Institutions and DeFi Protocols.

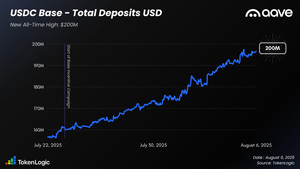

$200M of $USDC now deposited on Aave Base!

The Base Incentive Campaign was launched on July 23, and since then, USDC deposits on @base have grown by 22.7%.

This campaign was led by TokenLogic and @aavechan, with a clear objective: grow the Aave Base Market.

It seems the collaboration is working — the recent growth speaks for itself.

11.38K

70,000 $AAVE Bought Back!

Since launching the buyback program on April 9th, Aave DAO has accumulated 70,000 $AAVE, spending $15.7M at an average price of $223.33.

At today’s price of $261, these purchases are now worth $18.3M, a profit of $2.6M.

And now? Buybacks are still ongoing, with around $1M being deployed each week.

17.92K

.@aave's ETH holdings are now live on Strategic ETH Reserve 🦾

Very cool @fabdarice

fabda.ethAug 4, 02:25

📊 SΞR UPDATE: @aave's treasury holds 11,593 ETH ($40M).

The leading DeFi lending platform is stacking ETH.

Big thanks to @Token_Logic for providing the accurate data.

3.81K

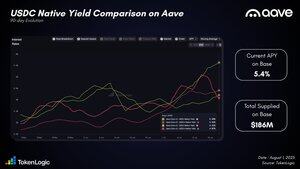

The most attractive place to earn yield on $USDC on Aave right now is @base.

Currently averaging 5.63%, that’s:

▪️ +1.2% higher than on Optimism

▪️ +1.4% higher than on Ethereum

▪️ +1.5% higher than on Arbitrum

And this doesn’t include the +1% additional APY available through Merit Program.

More than $186M of $USDC is already deployed there.

If you've got idle $USDC, it's time to make it work on Base.

11.72K

New incentives are live on Avalanche 🔺

Supply $GHO and earn 13.08% APY, currently the highest yield for stablecoin lending on @avax.

This includes a fixed 10% APR paid in $asAVAX, available until total deposits reach $50M — after that, the yield starts to dilute.

$asAVAX rewards are claimable on the ACI website.

Start earning here:

9.56K

Aave has now reached $170M in cumulative revenue.

With over $57M earned since the start of the year, Aave's 2025 revenue is already 1.44x higher than in 2024 and more than 7x higher than in 2023 at the same point in time.

Over the past 90 days, daily revenue has surged by 187%.

This growth is driven by strong borrowing demand, particularly in $USDC, $USDT, and $ETH.

Together, borrow interest from these 3 assets on Ethereum accounted for 59.1% of total revenue generated in Q3 2025:

▪️ $ETH: 29.7%

▪️ $USDT: 18.6%

▪️ $USDC: 10.8%

For the past two years, Aave has consistently captured between 60% and 80% of all revenue generated in the lending sector, and that trend shows no sign of slowing down.

Powered by multiple sources, this revenue stream is not only sustainable but also reinvested strategically by the DAO through:

▪️ Service providers

▪️ $AAVE buybacks

▪️ Umbrella emissions

▪️ Merit Program

These are just a few examples. The Aave DAO takes great care in allocating funds on various growth initiatives and buyback programs.

13.98K

$sGHO supply just hit a new ATH at 160.75M!

Today, you can earn 7.93% yield on a risk-free savings product, entirely funded by Aave’s $100M+ in annual revenue.

No slashing. No cooldown period. Just $GHO yielding at 7.93%.

Btw, PT on @spectra_finance lets you lock in a yield higher than the current APY (7.98%).

You should also take a look at the $sGHO YT on @Pendle_fi. Maybe it is still undervalued, who knows👀

Want to explore other integrations? Check out the quoted tweet👇

TokenLogicJun 20, 2025

Umbrella has been live since June 5 and stkGHO, initially designed with slashing and cooldown, is now rebranded as sGHO, the new GHO saving product earning yield through the @AaveChan sGHO Merit campaign.

Plenty of new ways to use $sGHO just dropped

Let's dive in👇

20.41K

With over $285M in coverage, Aave is by far the most secure lending protocol in DeFi.

Umbrella shields the protocol in real time from bad debt on $ETH, $USDC, $USDT, and $GHO.

Together, $ETH, $USDC, and $USDT represent 87% of total borrowings on the Core instance, which is why they were selected for Umbrella coverage.

Bad debt is one of the biggest threats for any lending protocol.

Without proper protection, it can completely collapse and never recover, as this kind of failure breaks trust and damages the platform’s reputation.

Aave and Gearbox are the only protocols that have funds allocate for protecting users, with Umbrella being the first fully automate system built by @bgdlabs.

Its coverage is 2.5x larger than the combined treasuries of Morpho and Euler.

No other protocol comes close to this level of protection.

And the best part? It is fully funded by over $100M in real, organic protocol revenue, with an annual budget of $9.1M.

In return, users who deposit earn juicy yields. For example, stkaUSDT is currently yielding 9.9%.

24.26K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable