Populární témata

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Obrovská zpráva pro všechny obchodníky se sazbou financování.

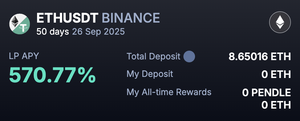

Společnost @pendle_fi spustila Boros @boros_fi, novou onchain platformu na Arbitrum, která uživatelům umožňuje obchodovat s sazbami financování od perpů CEX, jako je Binance, spíše než s cenou aktiv, jako je $BTC nebo $ETH.

Namísto spekulací na směr ceny Boros zavádí výnosové jednotky (YU, podobné YT na Pendle), YU-ETH představuje výnos financování z 1 ETH perp, což uživatelům umožňuje jít do dlouhé pozice, pokud očekávají růst sazeb financování, nebo krátké, pokud očekávají, že klesnou.

To odemyká novou vrstvu strategie, zejména pro protokoly, jako je @ethena_labs, s TVL téměř 10 miliard USD, které se spoléhají na pozitivní sazby financování pro generování výnosů stablecoinů a nyní se mohou zajistit efektivněji bez složitého nastavení OTC.

Počáteční trakce je silná, protože 800 tisíc USD je již uloženo do Liquidity Vaults.

S limity 10 milionů dolarů OI na pár (prozatím pouze BTC / ETH), 1,2násobným pákovým efektem a brzkou rozšiřující se podporou možná ještě není Boros přátelský k maloobchodu, ale už plánuji připravit pár příspěvků o tom, jak tam můžeme zajistit naše pozice.

Kromě toho neexistuje žádný 2. token, díky čemuž je $PENDLE ještě cennější, protože bude použit na pobídky a všechny poplatky za obchodování získané protokolem.

Obrovský milník nejen pro Pendle, ale pro celý kryptoprostor. Jsem opravdu nadšený z týmu a přeji jim do budoucna obrovský úspěch.

Top

Hodnocení

Oblíbené